A Ponzi scheme is an investment fraud where the operator generates returns for older investors through revenue paid by new investors rather than legitimate business activities or profit from financial trading.

The name “Ponzi” is courtesy of an Italian immigrant to the US, Charles Ponzi, a fraudster who promised investors mind-boggling returns of 50% for 45 days and 100% for 90 days.

Ponzi had told investors that he was using their money to purchase discounted postal reply coupons in other countries and then redeeming them at face value in the U.S., earning a profit for himself and his investors.

He was, however, using new investors’ funds to pay off returns to earlier investors in a circus that is also known as a “pyramid scheme fraud.”

A pyramid scheme fraud works as long as there is a steady inflow of new investors’ money. When the inflow slows down, the pyramid scheme collapses.

In Charles Ponzi’s case, financial investigators unraveled his scheme in 1920 and it was estimated that investors lost between $20 million to $25 million, which would be hundreds of millions in today’s dollars.

Ponzi was arrested and charged with multiple counts of fraud. After serving time in prison, he was deported back to Italy.

1. TransContinental International Inc. – By Lou Pearlman – $1 billion

Lou Pearlman was a major player in the music industry, known for his knack for creating hit-boy bands like the Backstreet Boys, NSYNC, and O-Town.

However, he’s more infamous for orchestrating one of the longest-running Ponzi schemes in the U.S.

He cleverly leveraged the fame of his boy bands to lure investors into his two companies; Trans Continental Airlines and Trans Continental Records, all under the umbrella of Trans Continental International Inc.

He falsely claimed these ventures were insured and approved by the Federal Deposit Insurance Corporation (FDIC), and received hundreds of millions of dollars in investors’ money.

In February 2007, the truth about his shady dealings came to light, and regulators took control of his companies, realizing it was all a massive fraud.

Lou was arrested while on the run in Bali, Indonesia, and ended up getting a 20-year prison sentence after admitting to lying, money laundering, and conspiracy.

He died in prison in 2016. Investors in his companies lost over $1 billion, $300 million of which is still missing to this day.

2. Mutual Benefits Corporation – By Joel Steinger – $1 billion

Joel Steinger is who you’d call a repeat offender or a career criminal. Steinger, who had already been banned by the SEC for selling fraudulent commodity options, dabbed with a diet pizza and oil wells scam before setting up Mutual Benefits Corporation (MBC).

Mutual Benefits Corporation (MBC) was a Florida-based investment company that traded in viatical settlements – shares on life insurance policies for terminally ill people.

Viatical settlements offer financial relief to life insurance policyholders with serious illnesses.

A settlement company pays the policyholder a fraction of the policy value, takes over subsequent premium payments and cashes in when the policyholder dies.

To attract investors, Joel Steinger and his associates bribed doctors to exaggerate patients’ conditions and provide fake prognosis, often indicating that the terminally ill policyholders were going to die sooner than was the case, thereby creating an illusion of a sooner payday.

With patients living longer than the medical reports indicated and new oblivious investors pouring in fast, Joel Steinger and his associates lived a life of luxury.

To keep the façade going, MBC would use proceeds from new investors to pay off subsequent premiums on active insurance policies in a classic case of a Ponzi scheme fraud.

Several dejected investors, on realizing that 90% of patients were living much longer than expected, filed complaints that led to the arrest of one of the doctors Mr. Steinger was using for fake prognosis.

In 2004, the Securities and Exchange Commission shut down MBC with investors losing an estimated $1 billion.

More than a dozen people were convicted in the case, including the scheme leader, Joel Steinger, who was sentenced to 20 years in prison.

3. Rothstein, Rosenfeldt And Adler, P.A – $1.2 billion

Scott Rothstein was behind a high-profile Ponzi scheme involving his law firm, Rothstein Rosenfeldt Adler.

His firm, based in Fort Lauderdale, Florida, primarily dealt with complex legal matters and high-stakes litigation and at its peak, employed more than 70 lawyers.

Rothstein’s complex scheme involved selling shares in fictitious lawsuit settlements, promising investors huge rewards when the cases were settled.

The supposed lawsuits often involved sexual harassment, whistle-blower claims, and qui tam actions against large corporations.

With the investor sworn to secrecy and awaiting their huge payday, Rothstein would go to great lengths to keep the scam believable, including forging signatures of state and federal court judges, impersonating judges and Florida bar officials, and enlisting the help of corrupt law enforcement personnel.

The scheme began to unravel in late 2009 when the economic downturn made it impossible to onboard new investors to pay old investors. When the scheme ran out of money to keep the façade going, some disgruntled investors contacted federal agents looking to ascertain Rothstein’s claims.

Rothstein’s extravagant lifestyle of yachts, a private jet, sports cars, and huge donations to Florida politicians had also drawn the attention of authorities.

Investigations revealed that Rothstein had defrauded investors out of approximately $1.2 billion by running a pyramid scheme, using new investors’ money to pay returns to earlier investors.

To escape justice, Rothstein initially flew to Morocco, a country with no extradition agreement with the US, having stashed $16 million in a Moroccan bank account.

In a change of heart a few weeks later, he abandoned what would have been a life on the run and returned to the US to face his fate, convinced that cooperating with prosecutors may lead to a lighter sentence.

Scott Rothstein was arrested in November 2009 and subsequently pleaded guilty to multiple charges, including racketeering, money laundering, and fraud. In 2010, he was sentenced to 50 years in federal prison.

Rothstein’s extensive cooperation with federal authorities led to the arrest and conviction of over 30 of his former acquaintances, co-workers, and family members (including his wife).

It also led to huge fines for TD Bank which played a significant role in Rothstein’s scheme. The bank suffered large settlements that significantly contributed to the full compensation of most of Rothstein’s victims.

A part of Scott Rothstein’s 2011 deposition testimony read;

“It was ego-fueled. We were rolling, you know, we were — we were all, me, Stu, Lippman, Adler, Boden, we were living like rock stars; private jets, massive amounts of money. There were lots of things that kept fueling that. As I’m sure you realize from looking at everything, there came a point in time when the only portion about it, which was money, was keeping the Ponzi going. We had more than enough money to fuel our lifestyles. It was the power that got ahold of us and kept pulling this forward; the more power, the more money, the more money the more power, it kept going back and forth until it exploded.”

4. The Yilishen Tianxi Group – By Wang Fengyou – $2 billion

Between 1999 and 2007, the Yilishen Tianxi Group, led by its Chairman and Chief Executive Officer, Wang Fengyou ran a massive Ponzi scheme in China, swindling more than $2 billion from unsuspecting investors.

The Yilishen operation focused on ant farming of a unique variety of ants that it claimed to be using to manufacture a traditional Chinese medicine that cured hundreds of diseases.

Farmers or investors bought boxes of young ants for $1,600, reared them for 14 months then sold them back to the company at $2,100, representing a 30% gain.

It turned out that the ant farming was just a ruse. The pills that Wang manufactured from matured ants’ powder had zero health benefits as was revealed by the U.S. Food and Drug Administration in 2004 when it banned Yilishen products in the US.

For several years, Wang was using money from new investors to pay off old investors, while fabricating documents to create a false sense of financial success.

At the end of 2007, the Yilishen Tianxi Group filed for bankruptcy leading to huge street protests by mostly poor farmers who had invested in the company.

Wang was arrested, tried, found guilty of “instigating social unrest,” and sentenced to death. Fifteen company managers were also given sentences of between five and ten years.

Wang was arrested, underwent a trial, and was convicted of “instigating social unrest,” ultimately receiving a death sentence. Additionally, fifteen of his company executives were handed prison terms ranging from five to ten years.

Tragically, there have been reports of several suicides linked to those who lost their life savings in the Yilishen Tianxi Group Ponzi scheme.

5. Bitconnect – By Satish Kumbhani – $2.4 billion

Bitconnect was a cryptocurrency-based investment scheme that enticed investors with promises of massive profits that sometimes went up to 1% daily returns.

Launched in 2016, it had a trading platform where investors could use Bitcoin to buy their digital coin, the BCC which would then be lent back to Bitconnect for a daily interest payment.

All investors had to do to earn money was buy BCC coins and sit back. Bitconnect claimed to have a sophisticated trading bot to generate these profits for their investments.

At its peak, BCC was one of the top 20 crypto coins in the world with BitConnect’s market cap of $3.4 billion.

However, the scheme was revealed to be a Ponzi scheme, where returns were paid to earlier investors with the money from later investors, rather than from actual trading profits.

Following warnings to investors by regulatory authorities in various countries, including the U.S. and the U.K., Bitconnect’s continuous influx of new money began to flounder.

In January 2018, Bitconnect announced that it was shutting down its exchange platform due to legal threats and regulatory pressure.

This led to a crash in the value of BCC from a high of $500 to less than a dollar, leaving investors with significant losses.

In September 2022, Glenn Arcaro, the main US promoter of Bitconnect, pleaded guilty to his participation in the cryptocurrency Ponzi scheme and was sentenced to 38 months in prison.

However, the Indian national founder and CEO of BitConnect, Satish Kumbhani, indicted in the US for his central role in the scheme, vanished and remains a fugitive from justice.

6. Petters Co. Inc – By Tom Petters – $4 billion

Tom Petters was the mastermind behind the biggest scam in Minnesota.

His company, Petters Group Worldwide, operated across multiple industries, including retail and logistics. It owned brands such as Polaroid and Fingerhut, as well as a controlling interest in Sun Country Airlines.

Through his brokerage firm, Petters Co. Inc., he started selling promissory notes to investors with guaranteed returns of 15 percent to 20 percent.

He claimed to be generating these returns from the various business activities of Petters Group Worldwide which he presented as hugely successful, by doctoring financial statements.

In reality, he was using new investors’ money to pay returns to earlier investors, creating the illusion of success through a billionaire lifestyle of a private jet, a collection of yachts, luxury cars, many homes, political donations, and charity.

In 2008, the scheme fell apart as federal authorities launched an investigation into the company’s operations, prompted by numerous discrepancies and complaints.

As it became clear that Petters was running a vast fraudulent operation, the 10-year-old scheme collapsed with over $3.65 billion of investors’ money.

In 2009, Tom Petters was handed a 50-year prison sentence and is currently incarcerated at Leavenworth Prison in Kansas. He is appealing his conviction and maintains his innocence.

7. Stanford International Bank – By Allen Stanford – $7 billion

R. Allen Stanford ran a massive Ponzi scheme through his company, Stanford Financial Group, which was based in Houston, Texas.

Stanford Financial Group was ostensibly a wealth management firm that offered high-yield investment products, including certificates of deposit (CDs) and investment funds.

Stanford executed his Ponzi scheme by attracting as many as 30,000 investors from over 100 countries with promises of unusually high and consistent returns on CDs, supposedly backed by Stanford International Bank, a “successful” banking operation in the Caribbean.

In reality, the bank was a sham. To maintain the illusion of legitimacy, he used new investors’ money to pay returns to earlier investors, all while creating fraudulent documents and falsified financial statements.

The scheme began to unravel in early 2009 when the U.S. Securities and Exchange Commission (SEC) launched investigations triggered by his company’s consistently higher-than-market returns.

The SEC’s investigation revealed that Stanford had been running a fraudulent operation for years. The scheme’s collapse led to significant financial turmoil and exposed that Stanford had defrauded investors of approximately $7 billion.

R. Allen Stanford was arrested in June 2009 and convicted in 2012 on multiple charges, including fraud and money laundering. He was sentenced to 110 years in federal prison.

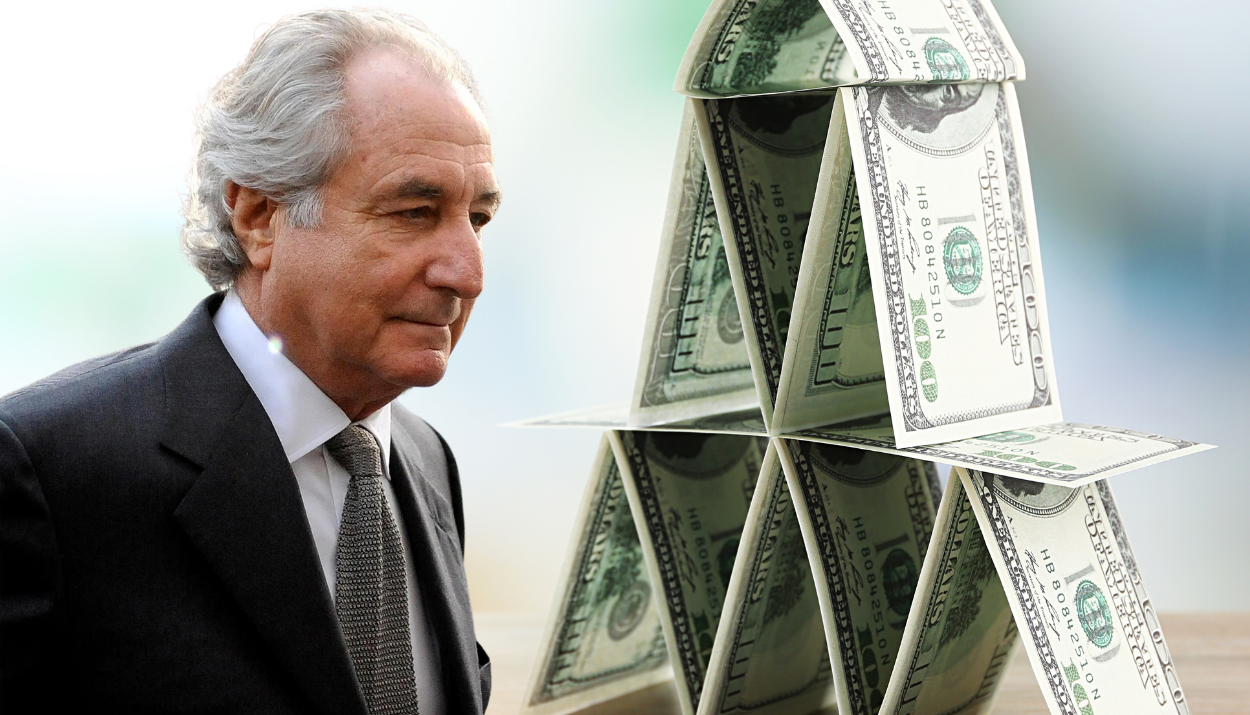

8. Bernard L. Madoff Investment Securities LLC. – $65 billion

Bernard L. Madoff Investment Securities LLC was an investment firm run by Bernie Madoff.

Madoff, a prominent American financier and philanthropist, was one of the founders and one-time chairman of the NASDAQ stock market.

He was the mastermind behind the biggest and one of the longest-running Ponzi schemes in history. The scheme attracted investors with the allure of steady profits, guaranteed through a “trading plan” he called a split-strike conversion.

For 17 years, Madoff used new investors’ money to pay returns to earlier investors, rather than generating legitimate investment gains.

Madoff’s reputation and connections in the financial industry coupled with an elaborate system of producing fake investment statements lent credibility to his operations, making him attract and retain investors.

The scheme unraveled in December 2008, precipitated by the year’s financial crisis, which led many investors to withdraw their funds simultaneously, exposing the lack of actual investments.

It is estimated that Madoff’s Ponzi scheme defrauded investors of approximately $20 billion in principal amounts and a further $45 billion in fabricated returns that were promised but never actually earned.

Madoff’s fraudulent activities ensnared a range of victims, including a charitable trust for real estate magnate Mortimer Zuckerman, the foundation of Nobel laureate Elie Wiesel, a charity of movie director Steven Spielberg, famous personalities like Larry King, Sandy Koufax, and Kevin Bacon, as well as prominent banks such as; Japan’s Nomura, Britain’s HSBC and Royal Bank of Scotland, Spain’s Grupo Santander, and France’s BNP Paribas.

In 2009, Bernie Madoff was convicted of 11 federal felonies, including securities fraud and investment advisor fraud.

He died in prison on April 14, 2021, at the age of 82, while serving a sentence of 150 years.